Amicus Invest offers three unregulated offshore investment products:

- Amicus Bonus Cash Account: Pays 4% per year interest (3% on balances calculated daily and a further 1% “bonus” on balances calculated quarterly). Funds can be added and withdrawn at any time.

- Amicus Regular Savings Plan: Pays interest on monthly investments as follows: 6% for a 1 year term, 7% for a 2 year term, 8% for 3 years, 9% for 5 years and 10% for 10 years. Early withdrawals are permitted but forfeit all interest accrued.

- Amicus Single Investment Plan: Fixed term investments paying interest as follows:

- 3 months – 4% per annum

- 6 months – 5%pa

- 1 year – 6.25%pa

- 2 years and 3 years: “Guaranteed Total Return of 15.00% (equal to 7.25% pa.) and 26.00% (equal to 8.09% pa.)”

- 5 years and 10 years: “Guaranteed Total Return of 45.00% (equal to 8.75% pa.) and 100.00% (equal to 9.50% pa.)” – these numbers don’t add up, as a 45% return over 5 years is 7.7% compounded, and a 100% return over 10 years is 7.1% compounded.

The discrepancy between the rates available on 5 and 10 years is not explained, nor is it explained why investors would want to receive a lower rate of return for locking their money away for longer.

Who are Amicus Invest?

No information is provided on the Amicus website as to who owns or controls the business.

Despite displaying an Austrian address on its website, Amicus Investment Ltd is registered in the Marshall Islands (a small country in the Pacific Ocean with a population of just over 50,000).

Pictures on the website which supposedly show Amicus Investment “advisors” are in reality stock photos.

The company was incorporated in 2011, redomiciled from the Bahamas to the Marshall Islands in 2013, and the amicusinvest.com website was registered in May 2013.

How safe is the investment?

These investments are unregulated corporate loans and if Amicus Investment defaults you risk losing up to 100% of your money.

Amicus claims that investors’ funds are invested into “a range of interest bearing instruments like consumer loan portfolios and corporate bond funds. The rest of our assets are invested into equities globally.”

Should Amicus fail to make sufficient returns from its consumer loans and other assets (e.g. due to a fall in the markets or defaults by its borrowers), there is a risk it may be unable to return investors’ money.

The use of terms like “Guaranteed” and “Cash Account” to describe loans with a risk of 100% capital loss is highly misleading from a regulatory perspective, and would not be permitted if Amicus was regulated in the EU or most other developed markets.

Should I invest with Amicus Investment?

This blog does not give financial advice. The following are statements of publicly available facts or widely accepted investment principles, not a personalised recommendation. Investors should consult a regulated independent financial adviser if they are in any doubt.

As with any unregulated corporate bond, this investment is only suitable for sophisticated and/or high net worth investors who have a substantial existing portfolio and are prepared to risk 100% loss of their money.

Any investment offering up to 8% per annum yields should be considered high risk. As an individual security with a risk of total and permanent loss, Amicus’ investments are higher risk than a mainstream diversified stockmarket fund.

Amicus Investment is regulated in the Marshall Islands and does not claim any other regulatory authorisation. This means its investments cannot legally be marketed to investors in the USA, the UK, the EU or other jurisdictions where you require authorisation from their own regulator to offer securities or financial promotions.

Amicus Investment is regulated in the Marshall Islands and does not claim any other regulatory authorisation. This means its investments cannot legally be marketed to investors in the USA, the UK, the EU or other jurisdictions where you require authorisation from their own regulator to offer securities or financial promotions.

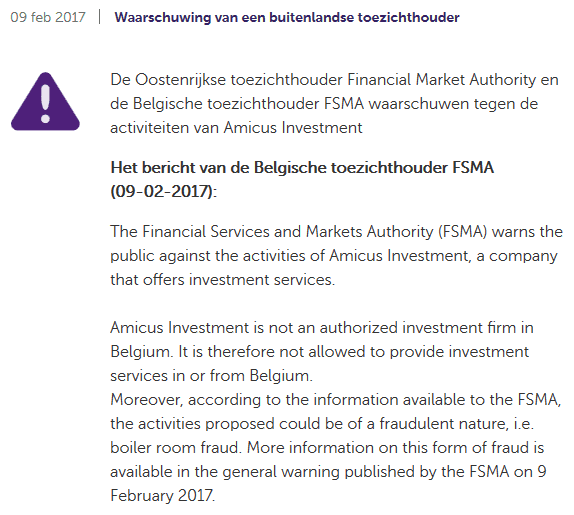

Amicus has already been subject to warnings from regulatory authorities in Austria and Belgium.

Under Amicus’ “Frequently Asked Question” section, one FAQ is as follows: “I read that the financial regulatory authority of a country has issued a warning about Amicus Investment. What does it mean?” Amicus rather brazenly replies: “Amicus Investment Ltd. is registered in the Marshall Islands. We offer our financial services to clients from all over the world, following the legislation of the Marshall Islands. Therefore, we are not bound by other countries’ financial authorities and such warnings have no effects on our business.”

The fact that Amicus is, according to its own website, “frequently asked questions” about these regulatory warnings should be enough to give investors pause.

This is my experience Amicus Invest: My partner told me well about Amicus Invest, two investments in 2018 both returned. In November 2018 my first Amicus investment. 78,000.00 with the request to return after 4 months. Amicus accepts and I transfer. To date, I have received only 25,000.00 euros back six months after the expiry date of the investment contract. BECAUSE I DO NOT WANT TO INVEST MORE WITH AMICUS: 1) I have signed a written contract from them, which however they themselves allow themselves to not respect. 2) Amicus says “we do not cheat, we are in trouble and we will pay our debts late, but we will pay”, (but you are not good at all!) What is the border between simple delay and fraud? a month? one year? all my life? … “But come on, we are only late with payments!”, but in the meantime 10 years have passed !!! They give short deadlines but they are punctually disregarded and in the meantime the months pass … 3) If it were a Company with a capital “A”, after admitting the difficulties, they should be activated to put into effect that “Guarantee” that they so much emphasize in their website “Guaranteed Investments”. A serious company does not hold the money of others to the bitter end without even setting a repayment plan: CERTAIN DATES RESPECTED, EVEN FOR SMALL AMOUNTS IF YOU CANNOT GIVE MORE, even just € 100.00 a month if this is what they can guarantee with their difficulties. I would much more appreciate a little constant effort over time than many announcements of payments almost always disregarded that sound too much like a joke. However, I see many recent positive reviews in which Amicus services are praised as punctual and profitable, we see that they do two weights and two measures, because as far as I am concerned they will be so good but for me Amicus Invest is also NO!

i have an amount there, in multiple coins, but most of it is BTC ,the wallets are all OFFLINE, and they respond only once, 1 month ago, any idea for help? i emailed them for 2 months. They said they have problems with servers or something like that. I use they services for years. they are simply fraud. i got back my money with the help of professionals.