Blueprint Industrial Engineering PLC is offering four year bonds (maturing 30 June 2022) paying interest of 6% per year.

Blueprint Industrial Engineering PLC is a holding company for one wholly-owned subsidiary, B.I.E. Sweden AB, which in turn wholly owns AMAB Arvika Montage AB.

The company’s shares are listed on the Emerging Companies Market of the Cyprus Stock Exchange, although appear to be thinly traded (at time of writing, no recent transactions were visible on the CSE website).

Money raised from investors is to be used to meet Blueprint’s overdue payments to the sellers of Arvika Montage (see below), and more generally to enable the company to acquire further Nordic engineering businesses.

Who is Blueprint Industrial Engineering?

Blueprint Industrial Engineering is headed by group CEO Jan Lindholm, who also holds a 25-50% shareholding according to Companies House.

Blueprint Industrial Engineering has been loss-making since the 2015/2016 accounting period, with its most recent results (April 2018) showing a £586,000 net loss in 2017/18, a slight improvement from a £590,000 net loss in 2016/17.

As at the April 2018 accounting date, the company’s liabilities exceeded its assets by £2.7 million (£6.3 million total liabilities vs. £3.6 million total assets).

According to the April 2018 accounts, the company is dependent on raising further money from investors (e.g. via these bonds) in order to complete its acquisition of Arvika Montage AB, currently its only subsidiary. Blueprint has already failed to meet the original payment schedule and has negotiated a payment plan to complete the acquisition by December 2018.

However, the directors are confident that they will raise the funds needed and thereby continue to run the business as a going concern.

Going concern

At 30 April 2018 the Group had a net working capital deficit of £2.1 million which included deferred consideration of £1.3 million due to the vendors of Arvika Montage AB. Since the end of the year the Group has received over £0.5 million from the issue of bonds and the directors are confident that bonds will continue to be issued to provide sufficient funds to meet the Group’s obligation to pay the deferred consideration and to finance working capital. However, there is no guarantee that the Group will have access to future debt finance or the ability to generate positive cash flows and this represents a material uncertainty which casts significant doubt upon the Group’s continued ability to operate as a going concern, such that it may be unable to realise its assets and discharge its liabilities in the normal course of business. The financial statements have been prepared on a going concern basis which assumes that the Group will be able to realise its assets and settle its obligations in the normal course of business.

How safe is the investment?

These investments are corporate loans and if Blueprint defaults you risk losing up to 100% of your money.

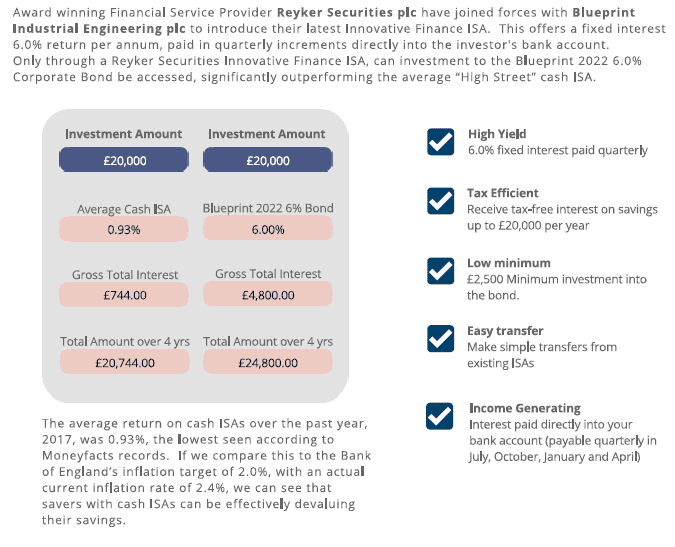

A brochure prepared and issued by Blueprint and approved by City One Securities (a firm authorised by the FCA, but permitted to conduct corporate finance business only) compares the 6% offered by Blueprint bonds with the 0.93% offered by an average cash ISA.

This is a totally misleading and irrelevant comparison, as cash ISAs have no material risk of loss as they are covered by the Financial Services Compensation Scheme, which Blueprint’s bonds are not.

With recent rulings from the Ombudsman emphasising that FCA-authorised firms who approve marketing material for unregulated investments can be held responsible for those promotions, it is disappointing that some are not taking their responsibilities seriously.

The fact that this marketing material predates the recent Ombudsman rulings against Independent Portfolio Managers is not an excuse – the financial promotion rules have been in place for years and comparing a cash ISA with a capital-at-risk corporate bond has never been anything other than misleading.

If Blueprint fails to make sufficient returns from its engineering investments, or for any other reason Blueprint runs out of money to service these bonds, there is a risk that they may default on payments of interest and capital to investors.

Should I invest in Blueprint Industrial Engineering plc?

This blog does not give financial advice. The following are statements of publicly available facts or widely accepted investment principles, not a personalised recommendation. Investors should consult a regulated independent financial adviser if they are in any doubt.

As with any corporate bond, this investment is only suitable for sophisticated and/or high net worth investors who have a substantial existing portfolio and are prepared to risk 100% loss of their money.

As an individual security with a risk of total and permanent loss, Blueprint’s bonds are higher risk than a mainstream diversified stockmarket fund.

Before investing investors should ask themselves:

- How would I feel if the investment defaulted and I lost 100% of my money?

- Do I have a sufficiently large portfolio that the loss of 100% of my investment in Blueprint would not damage me financially?

If you are looking for cash ISAs, you should not invest in capital-at-risk corporate bonds with a risk of 100% loss.

The investment may be suitable for high net worth and sophisticated investors who will already be well aware of all of the above risks, are looking to invest a small part of their assets in corporate lending, and feel that the return on offer (6%) is sufficient for the risks involved in lending to a small company listed in Cyprus.

This was run as an ISA that failed three years ago????

Can you be more specific? IFISAs didn’t exist three years ago and the company is still up and running – what exactly failed?

I find your reviews helpful so thank .reading your comment

This is a totally misleading and irrelevant comparison, as cash ISAs have no material risk of loss as they are covered by the Financial Services Compensation Scheme, which Blueprint’s bonds are not.

Does that mean that the FSCS guarantee your whole funds up to £85,000

Not for this investment.

I have been approached by a broker called Scott Flook and he claimed that the bond is fully protected by the FSCS ???After doing some research myself I found that that this company is not regulated or is offering FSCS protection in any shape or form!!!!!

When i called various times this week no 1 answered the phone only today the phone was answered by a gentlemen called Alex Upton ???

He claimed to be the manager of it all , when i asked some questions about my returns are they guaranteed he told they are not , so all an all STAY AWAY FROM THIS COMPANY AS FAR AS YOU CAN !!!!!

I’ve been called as well.

Really wonder where they got my details from?

Can anybody tell me if this company is registered ???

Mny thanks

Mark

If by registered you mean regulated by the FCA, then no, Blueprint is not.