Accumulate Capital are offering unregulated loan notes in their property business.

Current rates are only disclosed on providing contact details, however testimonials on their public website tout previous returns of up to 15% per year.

Accumulate Capital pays introducers up to 24% of investors’ money as commission, according to its website. Update 22.05.20: After this review was published the page in question promoting “up to 24% commissions” was removed from Accumulate’s website. This article was correct as at the date of publication. [end update]

Accumulate Capital pays introducers up to 24% of investors’ money as commission, according to its website. Update 22.05.20: After this review was published the page in question promoting “up to 24% commissions” was removed from Accumulate’s website. This article was correct as at the date of publication. [end update]

Accumulate Capital describes its bonds as “the AAA – Asset Assured Accumulator” and “Unique to the Property Development market”. In reality Accumulate’s “Asset Assured Accumulator” are just a standard loan note with a charge over Accumulate’s assets.

Who are Accumulate Capital?

Accumulate Capital Limited was incorporated in April 2019, originally as EQT Capital, and is wholly owned by Paul Howells.

Howells was previously a Partner at Signature Capital. For some reason, Howells has attempted to scrub his history with Signature from the Internet, having removed his association from his LinkedIn profile and other websites such as Vimeo.

Accumulate Capital was originally incorporated by another Signature figure, Sarah Schofield, who was previously a director of two Signature companies. Howells took over the company in July 2019.

Signature Capital is currently in administration; administrators were appointed to the parent company Signature Living Hotel on 21 April.

How safe is the investment?

In a page aimed at its introducers (the ones getting up to 24% commission), Accumulate states

As with all investments and property purchase, security is the key priority. […] Whilst our funding remains ‘unsecured’ in the capital stack, the remaining funding – sourced from private and institutional investors (including high street banks and challenger banks) – is secured via charges registered with the UK’s Land Registry. When we couple that with our high levels of ‘contingency buffers’ within the costing of a scheme, it ensures our investors that their positions are indeed ‘secured’.

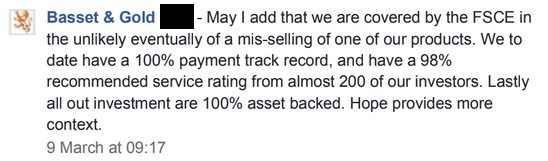

Secured lending is not risk-free as there is a risk that if the underlying borrower defaults, the security cannot be sold for enough to cover the loan – a point Vala itself makes in its brochure.

Investors in asset-backed loans have been known to lose 100% of their money when it turned out that there were not enough assets left to pay investors after paying the insolvency administrator (who always stands first in the queue).

We are not in any sense implying that the same will happen to investors in Accumulate, only illustrating the risk that is inherent in any loan note even when it is a secured loan.

If investors plan to rely on this security, it is essential that they hire professional due diligence specialists (working for themselves, not Accumulate) to confirm that in the event of a default, the assets of Accumulate would be valuable and liquid enough to compensate all investors. Investors should not simply rely on what Accumulate tells them about their assets.

Should I invest in Accumulate?

This blog does not give financial advice. The following are statements of publicly available facts or widely accepted investment principles, not a personalised recommendation. Investors should consult a regulated independent financial adviser if they are in any doubt.

As with any individual loan note to an unlisted startup company, this investment is only suitable for sophisticated and/or high net worth investors who have a substantial existing portfolio and are prepared to risk 100% loss of their money.

Any investment that offers returns 12.5% – 15% per year (to go by Accumulate’s advertised returns for previous investment projects) is inherently extremely high risk.

This goes double when an investment pays extremely high rates of commission to introducers. If Accumulate pays 24% of an investor’s money out as commission (to go by the figure on its own website), it has to make a 32% return before its own overheads and costs, just to get back to where it started, before any interest is paid to the investor.

As an individual, illiquid security with a risk of total and permanent loss, Vala’s loan notes are much higher risk than a mainstream diversified stockmarket fund.

Before investing investors should ask themselves:

- How would I feel if the investment defaulted and I lost 100% of my money?

- Do I have a sufficiently large portfolio that the loss of 100% of my investment would not damage me financially?

- Have I conducted due diligence to ensure the asset-backed security can be relied on?

If you are looking for an “assured” investment, you should not invest in corporate loans with a risk of 100% loss.