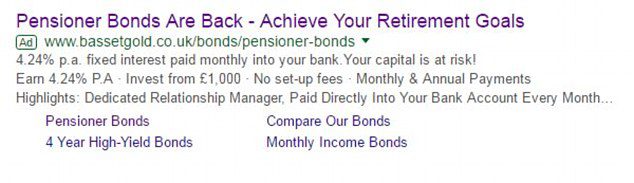

Last October I reviewed bonds offered by Symtomax, an unregulated cannabis investment scheme, which paid returns of 30% over two years.

At the time Symtomax’s bonds were being promoted by third party introducers on social media who claimed the investment offered “asset backed security” and was “Brexit proof”. I pointed out that like any individual corporate bond, the investment was in reality very high risk with an inherent possibility of 100% loss.

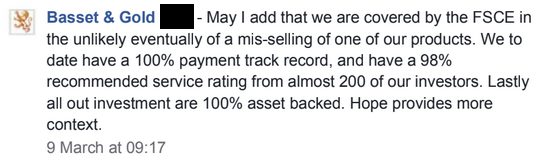

A number of comments were subsequently made underneath the article.

Last month Symtomax’s lawyers, Brett Wilson LLP, contacted me to complain about pretty much all the comments left under the article, as well as some minor discrepancies in the article itself. (The two discrepancies consisted of describing Symtomax’s director as a current rather than former regulatory official, and misattributing a Symtomax competitor’s market capacity to Symtomax itself, an error which came from one of Symtomax’s third party introducers.)

The law in the UK is very clear on the position when somebody complains about anonymous comments somebody else leaves on your website. To summarise, you contact the poster (if possible), and ask them to supply their real name and address to be passed to the complainant. If they demur or can’t be contacted, you remove the content at issue, or become legally responsible for it as if you posted it yourself.

All but one of the posters declined to provide their details and their comments were duly removed. The exception was a comment left by David Marchant, who runs the news website Offshore Alert from the USA, who stood by his comment and provided his full name and address.

This was duly provided to Brett Wilson LLP, who then proceeded to pursue their claim against Mr Marchant. Right?

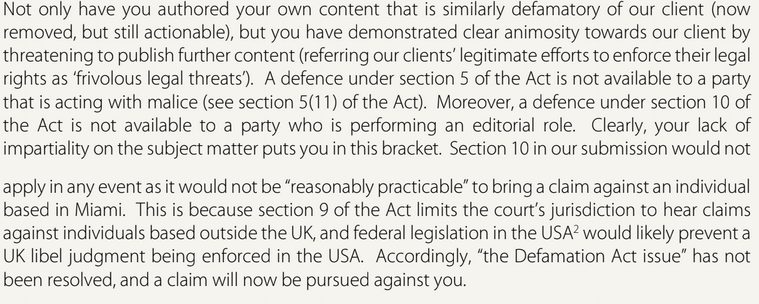

Well, not if you inhabit the alternate legal reality of BW. They have given notice of their intent to sue me over Mr Marchant’s comment anyway, on the grounds that

- it is not “reasonably practicable” to sue Mr Marchant in the USA

- the US courts will not enforce a UK libel judgement in the US

- the continuing presence of Mr Marchant’s comment, which mentions Symtomax directors by name, constitutes a violation of the General Data Protection Regulation.

Brett Wilson LLP have also demanded that I remove all content relating to the clients, despite my review being entirely factual, notwithstanding the minor corrections made. That Symtomax is a high risk investment scheme with an inherent risk of 100% loss is a matter of objective fact.

Brett Wilson describe themselves on their website as “a leading firm in defamation, privacy, harassment law, white-collar crime and regulatory/disciplinary work”. Yet they claim they are going to sue me because it’s too difficult to sue somebody in the United States. Right.

Nor does the GDPR change the fact that Mr Marchant remains responsible for his comment, having provided his full name and address so he can be sued over it. Any information I hold on Symtomax’s directors is in the public domain, as is the case for any director of an investment scheme promoted to the public.

Symtomax director banned

Symtomax director Minette Coetzee (formerly Minette Compson) has a complex CV. In 2014 she was banned from working in the Gibraltarian financial services industry over the sale of some Scottish land to Advalorem Value Asset Fund, whose board Coetzee sat on.

Advalorem Value Asset Fund was shut down by the Gibraltar Financial Services Commission in 2014 “to protect the interest of participants and potential participants” and wound up. Brett Wilson LLP are at pains to point out that while Coetzee was found by the Supreme Court “to have failed to act with due skill, care and diligence”, she was not found to have acted dishonestly.

Coetzee was also governance and compliance director of Privilege Wealth, a supposedly “low risk” minibond scheme which collapsed in 2018.

Privilege Wealth achieved one of the most notorious legal victories for an unregulated investment scheme when it successfully sued David Marchant – that same David Marchant – in the UK over an article he published claiming Privilege Wealth was fraudulent.

Marchant declined to turn up in a UK court, relying on the fact that UK libel judgements are not enforceable in the US. The judge therefore awarded victory to Privilege Wealth – and had no choice in the matter. But the judge went further than simply awarding a walkover, endorsing Privilege Wealth as “clearly not a fraud”. Less than a year later Privilege Wealth collapsed and its administrators described it as a “possible Ponzi scheme”.

The damages awarded against Marchant and the costs incurred by Privilege’s lawyers (Lewis Silkin LLP in that case) remain unpaid, and are unlikely to ever be paid.

Perhaps Privilege Wealth’s (entirely hollow) victory over Marchant in a UK court has given Symtomax’s directors a misplaced sense of confidence that they can sue people willy-nilly in the UK and win. Who knows.

What happens next?

I don’t disclose my full identity on request, and for the same reason I don’t disclose it because somebody has made up a load of nonsense about it being impossible to sue people in the USA.

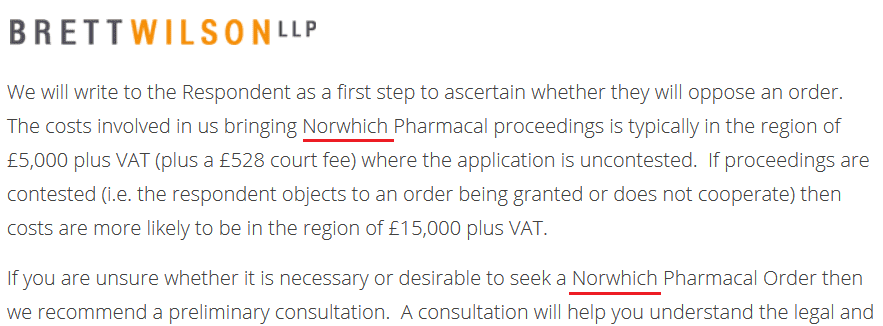

But that doesn’t mean I’m immune from responsibility and Symtomax do have the right to demand that I defend myself in court. As I have declined to voluntarily give up my identity, this involves Brett Wilson obtaining an “unmasking order” against me, also known as a “Norwich Pharmacal Order” after a famous legal case.

Brett Wilson’s expertise in Norwich Pharmacal Orders is there for all to see. When Googling “unmasking order”, the third result – effectively top after the ubiquitous Wikipedia and paywalled Thomson Reuters – is Brett Wilson’s helpful summary.

Which misspells “Norwich Pharmacal”. Twice.

Now, I don’t want to give the impression I’m being flippant about Symtomax’s right to take legal proceedings (judges don’t like it, being lawyers themselves) by laughing at unimportant typos. It just feels a bit like someone “sending the boys round”, and when the boys arrive on your doorstep they’ve got their shirts tucked into their underpants.

If I was the kind of person who’d cave in over a legal threat as flimsy as this one, Bond Review wouldn’t still be here after two and a bit years. If Symtomax insist on wasting their investors’ money on making me stand by my review, I will.

Watch this space…