Adelpha Capital is offering unregulated bonds paying interest as follows:

- 30 Day access bond – 4.5% per year quarterly income

- 18 month bond – 5.5% per year for quarterly income or 5.6% if rolled up and paid out at the end

- 3 year bond – 6% per year for quarterly income or 6.5% if rolled up and paid out at the end

- 5 year bond – 6.5% per year for quarterly income or 7.6% if rolled up and paid out at the end

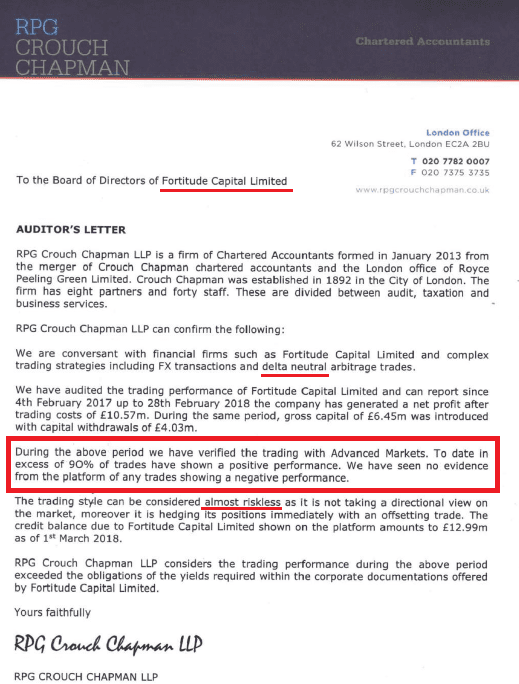

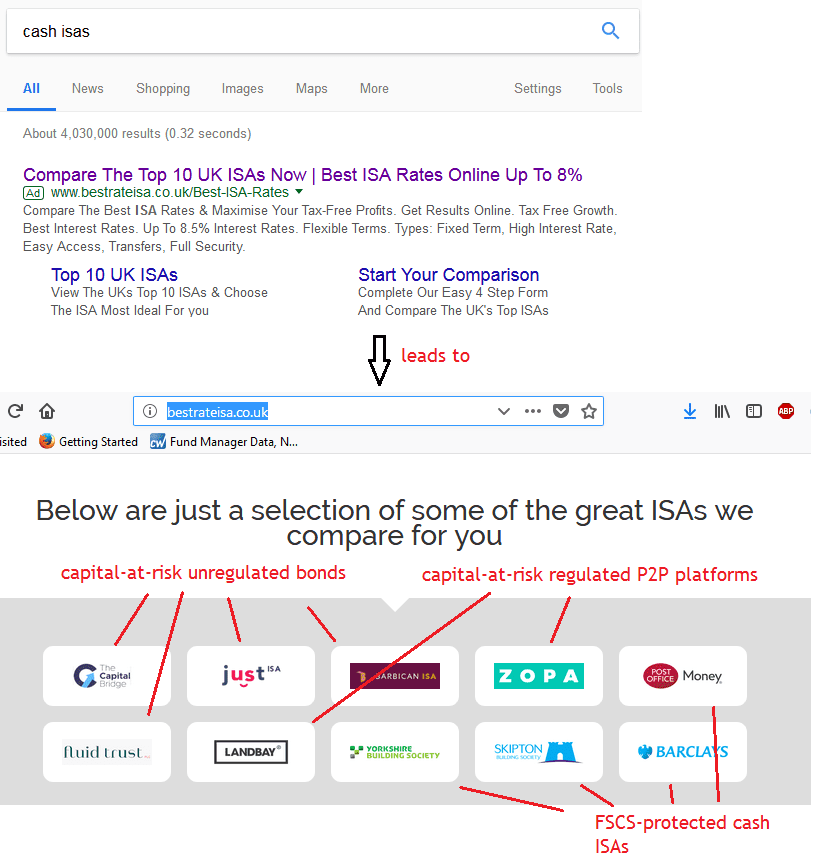

Adelpha Bond plc has an FCA-regulated sister company, Adelpha Capital Limited, which is an appointed representative of Met Facilities LLP. Adelpha Capital Limited has prepared and issued Adelpha Capital plc’s financial promotions. The investment itself however is unregulated; it is only the investment literature that has been produced by a regulated company.

Who is Adelpha Capital?

Companies House shows that Adelpha Capital Limited is wholly owned by Managing Director Lucas Vellely. Adelpha Bond plc is 100% owned by Adelpha Financial Group Limited, which is also 100% owned by Lucas Vellely.

Photographs provided on adelphacapital.com for both Lucas Vellely and the other director Lisa Kelleher proved to be stock photos as at 5 November 2018.

Investors should think very carefully before handing over money to an investment company which is not upfront about its ownership.

Adelpha Capital Limited was incorporated in October 2016. Its first accounts were filed with Companies House in October 2017 and showed it had minus £6,229 in net assets. Adelpha Bond plc and Adelpha Financial Group Limited incorporated in May and April 2018 respectively and are too young to have filed accounts.

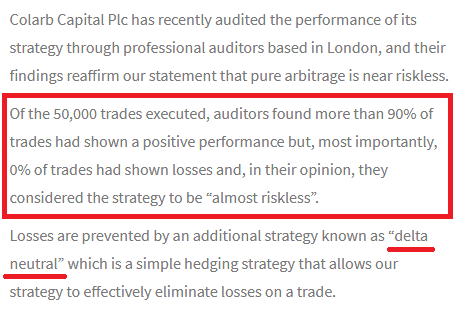

How safe is the investment?

Investors’ money will be used to lend either directly to individuals and businesses, or via “lending partners” including Peer to Peer lending platforms.

If Adelpha Capital fails to make sufficient returns from its lending business, there is a risk that they may default on payment of interest and capital to investors.

Adelpha Capital’s website and Offer Document is heavy on the use of the words “security” and “secured”. Its “about us” page uses the words “secured” or “security” three times, while “risk” is not mentioned until a risk warning at the end.

The risk warning at the bottom of each website does make clear that “Capital is at risk and returns are not guaranteed”.

Under the “security” tab on its website, it states

An Adelpha Bond is secured bond. [Sic – Brev] This means the bond is secured against/backed by the assets of Adelpha – the underlying lending portfolio – through a security document. In the unlikely event Adelpha is not able to make a bond payment, investors have a claim over Adelpha’s assets in order to help them get their money back.

The risk is that if Adelpha is unable to make repayments to its investors, its own borrowers may not be making sufficient repayments to Adelpha in turn, and the value of Adelpha’s assets – which is its lending portfolio – may not be sufficient to get their money back.

Investors in asset-backed loans have been known to lose 100% of their money (e.g. Providence Bonds and Secured Energy Bonds) when it turned out that there were not enough assets left to pay investors after paying the insolvency administrator (who always stands first in the queue).

We are not in any sense implying that the same will happen to investors in Adelpha Capital, only illustrating the risk that is inherent in any loan note even when it is a secured loan.

If investors plan to rely on this security, it is essential that they undertake professional due diligence to ensure that in the event of a default, Adelpha’s assets are valuable and liquid enough to raise sufficient money to compensate all investors.

Should I invest in Adelpha Capital?

This blog does not give financial advice. The following are statements of publicly available facts or widely accepted investment principles, not a personalised recommendation. Investors should consult a regulated independent financial adviser if they are in any doubt.

As with any corporate bond, this investment is only suitable for sophisticated and/or high net worth investors who have a substantial existing portfolio and are prepared to risk 100% loss of their money.

Any investment offering yields of up to 7.6% a year should be considered high risk. As an individual, illiquid security with a risk of total and permanent loss, Adelpha Capital’s bonds are higher risk than a mainstream diversified stockmarket fund.

Before investing investors should ask themselves:

- How would I feel if the investment defaulted and I lost 100% of my money?

- Do I have a sufficiently large portfolio that the loss of 100% of my investment would not damage me financially?

- Have I conducted due diligence to ensure the asset-backed security can be relied on?

The investment may be suitable for high net worth and sophisticated investors who will already be well aware of all of the above risks, are looking to invest a small part of their assets in corporate lending, have done sufficient due diligence, and feel that the return on offer (up to 7.6% over five years) is sufficient for the risks involved in lending to a new startup company.

If you are looking for a “secure” investment, you should not invest in corporate loans with a risk of 100% loss.