HPB Assurance Limited offers a Holiday Property Bond in which investors invest at least £5,000 in a bond holding holiday properties and securities. The bond pays no yield; instead, investors have the right to stay in HPB’s properties for a “no profit user charge”, which would presumably be less than they would pay to a conventional holiday provider for an equivalent holiday.

While at times its literature urges prospective investors to “only consider it for its holiday benefits”, the bond is structured as a life assurance bond (aka an insurance bond) which invests in shares and holiday properties, and terms like “investors” and “bondholders” are used liberally in its literature.

If it looks like an investment, and quacks like an investment, and I have to put money in upfront in the hope of a return (cheaper holidays than I’d get elsewhere + an eventual surrender payment) like an investment, it’s an investment.

HPB Management Ltd has been in existence since 1981 and is fully regulated by the FCA. This puts it outside the scope of what I usually review on this blog, but the unusual nature of the investment, the fact that it’s advertised directly to the general public via the colour supplements and suchlike, and the fact that these bonds are largely ignored by the mainstream investment industry, was enough to pique my interest.

Who are HPB Management?

No details of who is behind the business are provided on the HPB website.

HPB Management Ltd is 100% owned by Quality Holidays Assured Limited, which is incorporated in the Isle of Man. UK Companies House filings reveal that Robert Boyce, James Boyce and Geoffrey Baber have significant control of the company.

How does the bond work?

Investors must make an initial investment of at least £5,000 in the bond (although they can take out a loan with a minimum £2,000 deposit in order to invest – see “Geared investment” below).

The larger the investment, the more “Holiday Points” an investor receives each year, which allows them to take more HPB holidays or stay in larger properties. To stay in one of HPB’s properties, the investor pays Holiday Points plus a “no profit user charge” which covers running and maintenance costs.

Investors are locked into the bond from 14 days after their first HPB holiday until two years after investment. After that the bond can be surrendered at any time. The amount that investors will receive back will be reduced by HPB’s charges (see “Charges” below) and will also depend on the fluctuating value of the properties and securities held by the bond. HPB can delay withdrawals for up to a year if necessary to avoid selling a holiday property at a disadvantageous price.

The yield of the bond is effectively the difference between what the investor pays to go on an HPB holiday and what they would pay to go on a conventional holiday. The capital value of the investment will fluctuate depending on the value of the properties and securities held by the bond.

If investors are unable to use their Holiday Points in a given year, they can elect to receive cash instead if they give notice to HPB before the start of the year. As of January 2018 the cash alternative is 1.25% of premiums paid.

Performance

Assessing the past performance of the bond in the way that we would a conventional investment is virtually impossible.

The yield of the investment is impossible to quantify because it depends on what holidays the investor wants to take and what they would pay to take those holidays from a conventional provider vs. HPB’s “no profit user charge”.

The capital performance can however be assessed by viewing the performance of the Holiday Property Bond Series 1 fund via marketsft.com (ISIN GB0004674346). Since 5 June 1988 (the furthest FT.com goes back) the capital value of the bonds has fallen 38%; if the units were originally issued for £1 each, the value of the bonds’ assets have fallen by 46% since inception in 1983.

HPB’s literature says that 60% of the fund is invested in holiday properties and the remaining 40% in a portfolio of securities. I was unable to find a more detailed breakdown of what the fund invests in.

The temptation for an investor is to

- ignore the bond’s surrender value on the grounds they are having nice holidays

- ignore the full price they are paying for their holidays on the grounds that eventually they (or their family) will get back the money they put into the bond.

This is a recipe for disappointment when they eventually cash in their bond. In reality:

- You cannot know whether the bond is performing as an investment without knowing how much more you would have paid to go on conventional holidays and adding this saving onto the surrender value.

- You cannot know whether HPB holidays are good value without adding the difference between what you can get out of the bond and what you would have had from a conventional investment to your “no profit user charges” (and quarterly fees).

Geared investment

As mentioned above, investors can apply for an interest-free loan of between £3,000 and £9,000 in order to invest in the bond (with a minimum deposit of £2,000).

Borrowing to invest is a high-risk activity which is typically only suitable for highly risk-seeking investors.

The worst case scenario is that the value of the HPB bond collapses, but the investor still owes money to whoever the lender is. (Who the lender is is not specified on hpb.co.uk, but HPB Management does not appear to have FCA authorisation to issue loans itself, which suggests the loans may be arranged with a third party.)

This means their losses can exceed the amount invested; e.g. if they borrow £3,000 to buy a £5,000 Holiday Property Bond and the shares fall by half, they have an investment worth £2,500 but have to pay back a £3,000 loan, leaving them with minus £500.

Charges

The charges are described in advertisements as 25% upfront and 2.5% per annum.

Compared to conventional life assurance bonds these charges verge on the outrageous (no initial charge and all-in annual costs of 0.5% – 1.25% are currently typical for a non-advised portfolio of funds). But these charges may turn out to be more reasonable if the investor can recover some of this 25% and 2.5% by paying less for an HPB holiday compared to a similar conventional holiday, along with getting a decent return from the capital value of the bond. Whether this is likely is, as is the rule with Holiday Property Bonds, difficult to determine.

HPB also has the right to apply an exit charge (a bid-offer spread) of up to 6%. As of January 2018 it is not applying a bid-offer spread and says it has no plans to do so.

The more I think about the 25% upfront charge, the less I like it. My initial reaction was that it’s a rip-off, compared with conventional investments. My second reaction was that it may be unfair to compare it with conventional investments, as conventional investments don’t pay you in cheaper holidays.

My third reaction is that I still don’t like it. There is no way that HPB incurs upfront administrative costs of 25%. A holiday taken by an investor with a brand-new bond costs HPB the same as a holiday taken by an investor of 20 years. In theory the holiday should be paid for by the yield HPB makes from their investment, plus the “no profit user charge”.

Effectively new investors are subsidising old ones, with an investor who has taken enough holidays to recover the initial charge paying less for their annual holidays than a new investor. This cross-subsidy may have been acceptable in the 80s when heavily front-loaded charging structures were common, but is much less so in the post-2012 era.

Should I invest in a Holiday Property Bond?

As an investment, HPB is almost impossible to assess. As a holiday provider, HPB can only be recommended if you are so keen on staying in HPB’s properties, rather than those of its rivals, that you are prepared to shrug off any losses on the initial investment. A commonly seen argument by fans or representatives of Holiday Property Bonds is that the bond should not be viewed as an investment at all. My suggestion would be that if you don’t want to view it as an investment, then don’t invest.

The Holiday Property Bond clearly works best if you can hold on to it for a very long period – possibly for your lifetime – which renders the surrender value largely irrelevant, and also maximises your chance of recovering the eye-watering 25% initial charge. However, on the holiday side I question whether it is desirable to pay a large sum of money upfront and commit yourself to holidaying with a single provider for potentially your whole lifetime. In the AirBNB era I find this unattractive.

HPB describes their investment as “unique”, quite accurately. The fact that the product has been around for over 30 years and is still unique is a major question mark. When someone has a new investment idea that is profitable for all parties, it spreads across the markets like wildfire. For example, in 1975 John Bogle had an idea to launch a fund that did not exercise any judgment in what shares to invest in, while passing on the money saved on fund research and management to the investor via lower charges. 40 years on, you can’t move for index-tracking funds.

There is no copyright or patent on HPB’s product. If Holiday Property Bonds are a good investment and a good way to pay for a holiday, why are they still unique?

What are the alternatives?

Any diversified investment portfolio can be considered an alternative to Holiday Property Bonds, as investors can put the yield from their portfolio towards the cost of their annual holidays. No investments are guaranteed to make money, but a portfolio diversified across global mainstream stockmarkets is less likely to lose money in the long term in the way the Holiday Property Bonds Series 1 fund has since 2008, despite both world stockmarkets and commercial property indices having risen significantly in that time.

Like Holiday Property Bonds, conventional investments also pay a form of Holiday Points which can be exchanged for the right to stay in holiday properties around the world, but with a far greater choice of holidays; it’s called cash.

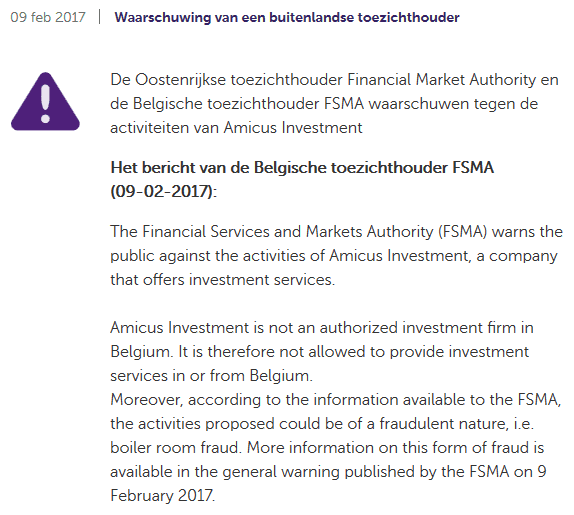

Amicus Investment is regulated in the Marshall Islands and does not claim any other regulatory authorisation. This means its investments cannot legally be marketed to investors in the USA, the UK, the EU or other jurisdictions where you require authorisation from their own regulator to offer securities or financial promotions.

Amicus Investment is regulated in the Marshall Islands and does not claim any other regulatory authorisation. This means its investments cannot legally be marketed to investors in the USA, the UK, the EU or other jurisdictions where you require authorisation from their own regulator to offer securities or financial promotions.

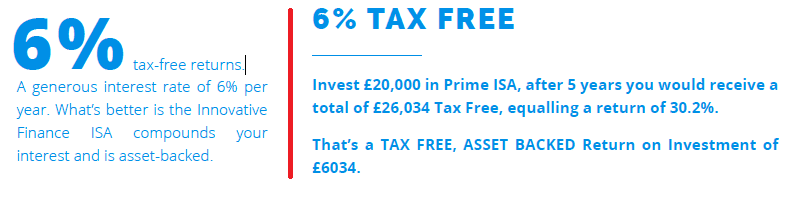

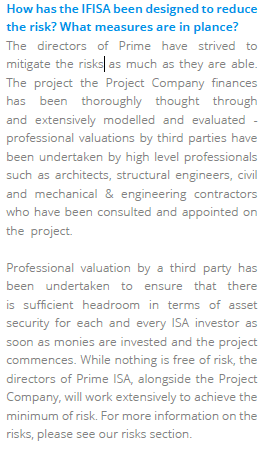

Regardless of what measures have been taken to reduce risk, as an individual security with a risk of total and permanent loss, Prime’s bonds are higher risk than a mainstream diversified stockmarket fund.

Regardless of what measures have been taken to reduce risk, as an individual security with a risk of total and permanent loss, Prime’s bonds are higher risk than a mainstream diversified stockmarket fund.