Godwin Capital is offering 2 year investment bonds paying either 10% per year with income paid out twice a year, or 11.3% per year if income is rolled up and paid at the end of the term (12% simple interest rolled up for two years = 11.3% compounded annual growth rate).

Who are Godwin Capital?

The bond is issued by Godwin Capital No. 2 Limited. This company is wholly owned by Godwin Capital Limited, which is in turn owned by the parent company, Godwin Property Holdings Limited. Godwin Property Holdings Limited was incorporated in June 2016.

The parent company is owned in equal quarters by the directors Stuart Pratt, Stephen Pratt, Richard Johnston and Andrew Mitchell.

The parent company’s last accounts (31 December 2016) show net assets of £94, while Godwin Capital No. 2 has not yet filed its first accounts.

How safe is the investment?

These investments are unregulated corporate loans and if Godwin Capital No. 2 defaults you risk losing up to 100% of your money.

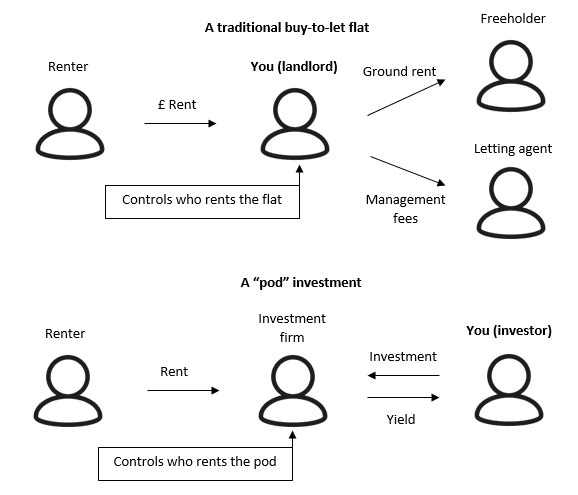

The purpose of the bonds is to allow Godwin Capital No. 2 to lend to other Godwin companies in the group, which in turn will invest bondholders’ money in property.

If Godwin’s sister companies fail to make sufficient returns from their property investments, resulting in them defaulting on the intercompany loans, or for any other reason Godwin Capital No. 2 runs out of money to service these bonds, there is a risk that they may default on payments of interest and capital to investors.

Asset-backed security

A legal charge over Godwin Capital No. 2’s investments will be held by a Security Trustee (More Group Capital Services Limited). These investments will consist of loans to other Godwin group companies.

The Security Trustee will also hold a first legal charge in respect of funds provided under inter-company loan agreements.

Investors should not assume that because their loans are secured on these assets, they are guaranteed to get at least some of their money back through sale of the collateral if the issuer defaults. Investors in asset-backed loans have been known to lose 100% of their money (e.g. Providence Bonds and Secured Energy Bonds) when it turned out that the collateral was insufficient to pay investors after paying the insolvency administrator (who always stands first in the queue).

We are not in any sense implying that the same will happen to investors in Godwin Capital, only illustrating the risk that is inherent in unregulated corporate loan notes even when they are asset-backed.

If investors plan to rely on this security, it is essential that they undertake professional due diligence to ensure that in the event of a default, these securities are valuable and liquid enough to raise sufficient money to compensate all investors, as well as any other creditors that Godwin Capital has borrowed money from.

This will require due diligence on the legal charges held not only over the assets of Godwin Capital No. 2 (which are intercompany loans) but on the legal charges over the physical propertes that Godwin group companies are to invest in.

Should I invest with Godwin Capital?

This blog does not give financial advice. The following are statements of publicly available facts or widely accepted investment principles, not a personalised recommendation. Investors should consult a regulated independent financial adviser if they are in any doubt.

As with any unregulated corporate bond, this investment is only suitable for sophisticated and/or high net worth investors who have a substantial existing portfolio and are prepared to risk 100% loss of their money.

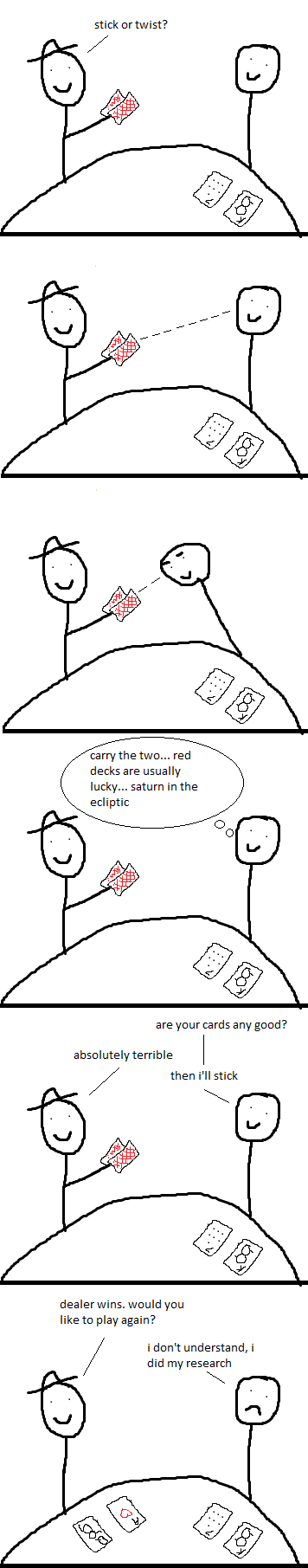

Any investment offering up to 10% per annum yields should be considered very high risk. As an individual security with a risk of total and permanent loss, Godwin Capital’s bonds are higher risk than a mainstream diversified stockmarket fund.

This particular bond is described as asset-backed. Before relying on the security backing the bond, investors should undertake professional due diligence to ensure that in the event of default, the security could be easily sold and would raise enough money to compensate all the investors, after the adminstrator deducts their fees and any higher-ranking borrowers are paid.

Before investing investors should ask themselves:

- How would I feel if the investment defaulted, the sale of the security failed to raise enough money to compensate all investors, and I lost 100% of my money?

- Do I have a sufficiently large portfolio that the loss of 100% of my investment would not damage me financially?

- Have I conducted due diligence to ensure the asset-backed security can be relied on?

If you are looking for a “guaranteed” investment, you should not invest in unregulated products with a risk of 100% capital loss.