Redhat Group claims to provide an “FCA Approved Managed FX Account” which “rewards our clients with above average returns by utilising our sophisticated Redhat Trading Platform.”

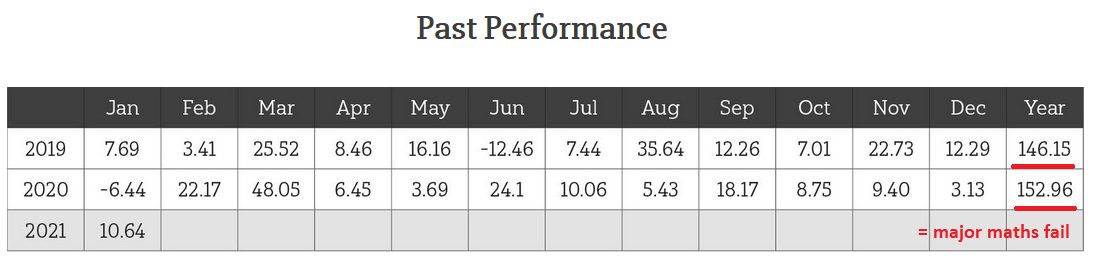

Past performance data on Redhat’s website claims that their investment delivered returns of 146% in 2019 and 153% in 2020.

There is also a live webpage on Redhat’s website offering a “Loan Note” paying 24% over 24 months, although it is orphaned (i.e. not accessible from the main website and only reachable with a Google search).

The company is currently advertising its forex investment on Facebook.

Who are Redhat Group?

Redhat Group plc, despite its name, is not a publicly listed company but privately owned, via Redhat Holdings Limited, by directors Michael Bold (CEO) and Craig Gabriel (COO, aka John Craig Gabriel).

Gabriel is also Chief Marketing Officer of Pardus Fixed Income Bond plc, previously reviewed here. Both Gabriel and Bold are also directors of Meredith Charles, an unregulated introducer which promotes a range of investments including Pardus on its website.

Redhat Holdings Limited was incorporated in 2016 but its latest accounts for October 2019 show it to be miniscule (£1,218 in net liabilities and £14 in gross assets).

How safe is the investment?

Redhat Group claims to offer “high returns” with “built-in risk mitigation processes”.

This claim starts to fall apart as soon as you look at its “Past Performance” table.

Redhat claim that their forex trading strategy has been “developed over a 6-year period” and produced returns of 146% and 153% in 2019 and 2020. In which case, why isn’t every hedge fund in the world beating down their door?

Probably because they can’t do basic financial maths. An investment which returned 7.69% in January, 3.41% in February, and so on, would actually have returned 272% over the year. That’s assuming you keep the capital invested from month to month and compound the returns, but when you’re making an average of 12.1% a month, why on earth would you do anything else?

So where does the figure of 146.15% come from? Adding up all the numbers on the left of it.

Redhat Group however has an even bigger issue than an inability to understand compound interest. Even if Redhat’s returns were real, it would still be breaking the law.

Redhat’s Facebook adverts and website represent a financial promotion. Issuing financial promotions in the UK requires authorisation from the Financial Conduct Authority. Redhat Group is not authorised by the FCA.

The only reason for Redhat Group to promote itself illegally instead of applying for FCA authorisation is if its fantastical returns don’t exist.

As Redhat Group has no magic strategy generating returns of 100 / 200% per year, any returns to investors will either be illusory (“numbers on a screen”) or, if real money is paid into an investor’s account, this will be funded by the investors’ own money or that of others, making Redhat Group a Ponzi scheme.

Should I invest with Redhat Group?

This blog does not give financial advice. The following are statements of publicly available facts or widely accepted investment principles, not a personalised recommendation. Investors should consult a regulated independent financial adviser if they are in any doubt.

Any investment offering returns over 100% or 200% a year is in reality a virtually guaranteed loser for all but those running it. The mathematics of Ponzi schemes guarantees that the vast majority, if not all, of investors will lose their money.

Do not invest unless you are prepared for total losses.

These two scammers at it again!

Well done Bond Review for finding this and making people aware.