At time of writing Marshbell offers the following investment terms:

- Silver: 4.65%pa paid monthly for a 1 year investment

- Gold: 8.4%pa paid monthly for a 2 year investment

- Platinum: 12.8% paid monthly for a 3 year investment

- Bronze: 10.2% rolled up and paid at maturity for a 2 year investment

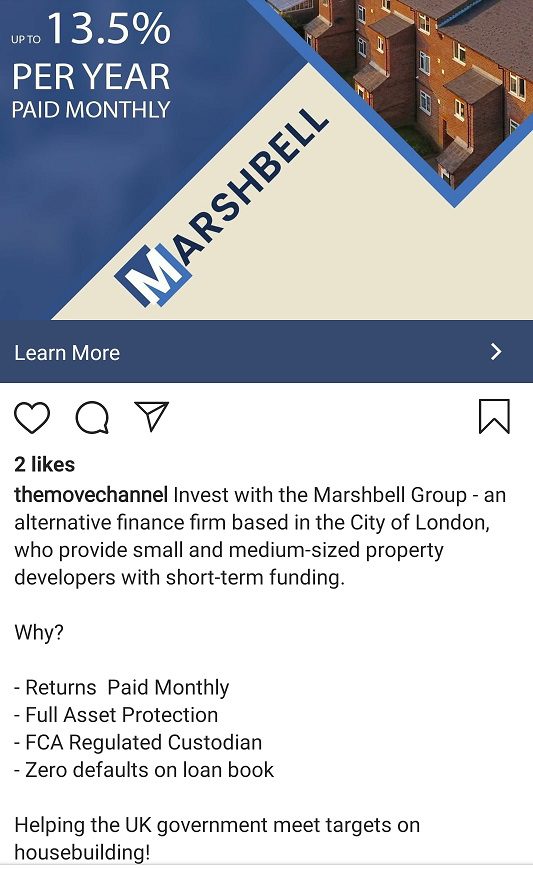

In November 2020 third party introducers for Marshbell were advertising an investment via Facebook and Instagram paying 13.5% per year. Specifics of the investment term were not provided.

Third-party introducers for Marshbell claimed via Instagram that Marshbell offers “Full asset protection” and “Zero defaults on loan book”. For more on these claims see below.

Who are Marshbell?

No details of who is behind Marshbell are disclosed on their website.

Companies House shows that Marshbell is owned by director Stewart Paterson.

I wasn’t able to find any history for Paterson. There’s a Stewart Paterson with the same month and year of birth in the investment (and male modelling) industry, but there’s no mention of Marshbell on his LinkedIn and I wasn’t able to find confirmation they are the same person. (Marshbell’s lack of disclosure on their website doesn’t help.)

Although Marshbell claims to have been “Debt finance specialists since 2016”, and the company was indeed incorporated that year, Marshbell’s accounts show that it was dormant until some point between October 2017 and 2018. Moreover, Paterson only took over the company in January 2020. Prior to that the company was wholly owned by a David Shapiro until January 2020 and a Ceri John until November 2018.

Those October 2018 accounts show that the company took in about £6 million of capital in the previous year and little else. They were unaudited and are therefore worthless for due diligence purposes without independent verification.

How safe is the investment?

Third-party introducers for Marshbell claim their investments offer “Full asset protection” and they have had “Zero defaults on loan book”. Marshbell itself claims on its website to be “Fully secured”.

Nonetheless, like any unregulated investment which previously paid 13.5% per year, this is an inherently high risk investment with an inherent risk of total loss.

Marshbell having “zero defaults” to date does not change this, especially given its young age.

Marshbell’s website states “Marshbell Group would preferably deploy capital on a joint venture basis with an existing business, targeting an annual return of 8% net, after paying all investors that may have subscribed via Marshbell’s investment instruments.”

Given this requires it to target an return of at least 21.5% per year (8% + 13.5% plus Marshbell’s other costs) it will need to lend to high risk borrowers willing to pay such interest rates.

Secured lending is not risk-free as there is a risk that if the underlying borrower defaults, the security cannot be sold for enough to cover the loan.

Investors in asset-backed loans have been known to lose 100% of their money when it turned out that there were not enough assets left to pay investors after paying the insolvency administrator (who always stands first in the queue).

This is not in any sense to imply that the same will happen to investors in Marshbell, only illustrating the risk that is inherent in any loan note even when it is a secured loan.

If investors plan to rely on this security, it is essential that they hire professional due diligence specialists (working for themselves, not Marshbell) to confirm that in the event of a default, the assets of Marshbell would be valuable and liquid enough to compensate all investors. Investors should not simply rely on what Marshbell tells them about their assets.

The dramatic difference between the different investment terms is cause for concern. Normally you would expect to see a percent or two difference between investment terms. It is not clear why the chance of Marshbell failing in year 3 so much higher than the chance of it failing in year 1 that it needs to offer a whole 8% more in annual interest.

Should I invest in Marshbell?

This blog does not give financial advice. The following are statements of publicly available facts or widely accepted investment principles, not a personalised recommendation. Investors should consult a regulated independent financial adviser if they are in any doubt.

As with any investment in an unlisted micro-cap company, this investment is only suitable for sophisticated and/or high net worth investors who have a substantial existing portfolio and are prepared to risk 100% loss of their money.

Any investment offering returns of up to 12.8% per year is inherently high risk. As an individual, illiquid security with a risk of total and permanent loss, Marshbell’s loan notes are much higher risk than a mainstream diversified stockmarket fund.

Before investing investors should ask themselves:

- How would I feel if the investment defaulted and I lost 100% of my money?

- Do I have a sufficiently large portfolio that the loss of 100% of my investment would not damage me financially?

- Have I conducted due diligence to ensure the “asset security” can be relied on?

If you are looking for a “protected” investment, you should not invest in loans to unregulated companies with a risk of 100% loss.

Hi net worth investors only – if you cannot afford to lose your money DO NOT invest please read that highlighted paragraph 10 times – no unregulated investment should be advertising as – safe – asset backed or such there should be no need if it is a really good choice – I am a previously burned to a crisp investor of this type of scheme – YOU have been warned

Asset-backed loan notes providing finance to property companies. What could possibly go wrong?

I am an investor with Marshbell and have invested money I am willing to risk. I was not born yesterday, I know if it is paying these rates, this will not be a low risk investment guaranteed investment. Let’s face it, you have to be “in it to win it” in life, and it would be unfair to create conspiracies that things will go wrong without giving companies a chance to get it right. There are plenty of financing companies who do things in a fit & proper way and succeed in financing projects.

I totally agree though, if you cannot afford to risk your capital, you should only be investing in mainstream FSCS protected investments governed by the FCA, etc. In Marshbell’s case, their website’s risk disclaimer, brochure and agreements, clearly outlined the risks involved, so I knew what I was getting myself into as an experienced Sophisticated investor.

If you are a “sophisticated investor” then I imagine you hired a professional to do due diligence on the company before investing instead of just believing everything a company you had never heard of before told you. If so please share what you found out.

I would direct you to some MSE discussions on the subject but their lawyers must have been active as I see the 2 main threads have been deleted.

By the way I see their stated address offers virtual offices. Not automatically a bad sign but it would make me pause and investigate.

Their own home page in the small print says they are not covered by the FAC yet I was told by an ‘advisor ‘ I would be paying into a FAC escrow account . Smells bad all round but probably will give good returns until it falls over and then the capital will be gone !

I invested with Marshbell 2 years ago and now I am struggling to get in touch with anyone I spoke to.

l took out a £5,000 2 year bond in April 2021 and the last contact from them was an account update in November. l have not been able to contact anyone in recent weeks so assume the Company may have now collapsed which l was from the outset well aware could happen. Frustrating that l can find nothing on the internet that has been recently posted but assume that if the Company no longer a going concern news to that effect will eventually appear on line.

What can you do to get your money back?