Last week I reported on the FSCS’ decision to compensate only 159 London Capital & Finance bondholders.

The decision to compensate only those who transferred stocks & shares ISAs to LCF, and not those who transferred cash ISAs, over a technical interpretation of the compensation handbook, has been a particular point of controversy.

The FSCS’ explanation in its LCF Q&A was

Arranging a transfer out of a regulated investment, such as a stocks and shares ISA, is a regulated activity.

As veteran investor activist Mark Taber pointed out to the FSCS on Twitter, cash ISAs are also regulated. The FSCS replied that what they meant to say was not regulated investment but designated investment.

We apply different sets of rules to different types of claim. If a bank fails, under the applicable Depositor Protection rules, a cash ISA qualified as a type of deposit that FSCS can protect.

However, for investment claims, under the applicable COMP rules, there is a strict requirement for there to be a ‘designated investment’ (see COMP 5.5.1(1)).

So there you have it – stocks and shares ISAs are “designated investments” under the FCA and FSCS handbooks but cash ISAs are not. Therefore compensation is payable where LCF transferred a stocks and shares ISA to its own invalid ISAs but not where it transferred a cash ISA. Does that explain everything?

No it doesn’t. If you’ve ever read a pulp fantasy novel, a Lord of the Rings knockoff, you will probably have read a paragraph like the following:

“The High Elves can use fire magic,” explained the wise wizard Fladnag to Odorf, “because their earliest ancestors were created from a star that fell from the sky, and the fire in that star remains in their blood. But the Wood Elves were made from the trees of the forests so they can only use the magic of nature.”

In the confines of fantasy novels this serves as an explanation as to why High Elves can do magic with fire. In reality it explains absolutely nothing. Using the words “because” and “so” doesn’t make it an explanation. At no point does the wizard explain what it is about your distant great-grand-parents being made from a star that gives you the ability to make magic fire. All the steps in between “great grandparent made from star” and “can summon fire” are missing. It is not an explanation, but random facts about elves.

This is fine in a pulp fantasy novel, as it’s a waste of energy coming up with actual scientific explanations, explanations where the steps in between aren’t missing, for things that aren’t real.

But the FSCS is doing exactly the same thing with ISAs in place of elves. “Stocks & shares ISAs are a designated investment but cash ISAs are only a regulated deposit” is not an explanation, it is random facts about ISAs. And this isn’t good enough, because it’s real life and whether compensation is awarded or not has a dramatic effect on real people’s lives.

What makes these facts irrelevant and random is that by the time the funds reached LCF’s hands, they were neither stocks & shares ISA funds or cash ISA funds. When a stocks & shares ISA was transferred to LCF, it was not LCF that sold the investments into cash but the original ISA manager. Any distinction between cash ISA funds and stocks and shares ISA funds had disappeared by the time they reached LCF’s hands for LCF to perform regulated activities upon them.

No part of the FSCS’ pseudo-explanation has managed to explain this away.

Cynicism abhors a logical vacuum

There is of course a real distinction between stocks & shares ISA LCF victims and cash ISA LCF victims that does provide a logical explanation for why only the former might get compensation.

There’s a lot fewer of them.

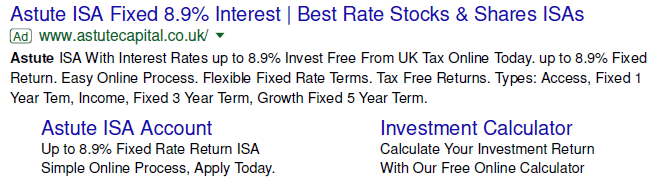

How many cash ISA LCF investors there are hasn’t been stated as far as I know. However, the archetypal LCF investor was your classic unsophisticated saver, sick of cash interest rates but lacking any experience of how to obtain real asset-backed returns without taking the risk of permanent loss. They went Googling for terms like “best interest rates” which LCF’s marketing provider Surge had sat on, and the rest is history.

Anyone with a stocks & shares ISA was inherently less likely to invest in LCF. They were already receiving potential returns higher than cash which takes away the main driver to go looking for LCF. They had at least some experience of capital-at-risk investments, via their stocks and shares ISA, and a higher ability to understand that LCF had an inherent risk of 100% loss, and giving them all your money was a bad idea for the same reason it is a bad idea to invest all your money in Lloyds shares.

Why 159 stocks & shares ISA investors managed to invest in LCF anyway is for them to come to terms with (fear of losses leaving them open to an investment that gave a false assurance of no volatility, maybe). It doesn’t matter as the point is that there are almost certain to be far fewer of them to compensate. 159 investors translates into a mere £3 million or so, assuming the typical average investment in LCF of c. £20,000.

Back in June 2019 when the FSCS was still dangling the prospect of compensating investors on the basis of misleading advice, I pointed out that this risked a number of unfair outcomes, including compensating richer investors who received personal visits from LCF salesmen while hanging poorer ones who didn’t out to dry.

I cynically suggested that the main benefit of rewriting the definition of “advice” in this way would be to remove the most organised and well-resourced investors from the investor groups – “divide and rule”.

Now we have the FSCS choosing to compensate a group who were by nature less unsophisticated and more experienced with investments than the average LCF investor, by virtue of the fact they already held capital-at-risk stocks and shares ISAs.

Those who had very little excuse for not understanding that LCF had an inherent risk of 100% loss are getting bailed out by the general public. Those who’d never held capital-at-risk investments before and likely had zero knowledge of how to diversify are still twisting in the wind.

There is no rational explanation for this, no matter how much the FSCS bleats about subsection C and paragraph 5.

Investor confidence

This isn’t a call for cash ISA investors to be compensated as well, and nor am I trying to piss on the lucky 159’s chips by saying they shouldn’t have been compensated.

This is about investor confidence. (I don’t expect LCF investors to care about macroeconomics over their own losses so they can put this article down if they’re still reading.) A financial compensation scheme needs to a) give retail investors enough confidence in the system not to hide their money under the mattress, and b) discourage retail investors from putting their money in the unregulated underbelly, where it is highly likely to be wasted, in the belief that it’s a risk-free bet.

By dangling the prospect that LCF investors might be compensated en masse over “misleading advice”, despite LCF not being an advisory firm, employing no financial advisers, and having no permissions to advise retail clients, the FSCS gave false hope to LCF investors for months. The nonsensical technical decision over stocks and shares ISA investors compounds the impression of a system in chaos.

The failure of the UK to regulate all investment securities offered to the public has created a fractured system where some unregulated investments are eligible for compensation and some aren’t, with no discernible logic.

The loopholes engineered by the current UK regulatory system allowed a business which was both unregulated and regulated, and offered high-risk unregulated securities that somehow still manage to be FSCS-protected in extremely limited circumstances, to exploit this lack of clarity for three years.

This is a shambles. A slaughterhouse into which investors will continue to be led until the system is reformed from the top down.