Astute Capital has filed interim accounts for the half-year ending September 2019.

As at September 2019 the company was on the edge of solvency with £6,000 in net liabilities.

According to director Richard Symonds, in April 2019 the company closed operations in Leeds and terminated all relationships with unregulated introducers. By this point of course the company had already raised £15 million.

Compliance support consultant Thistle Initiatives were hired to ensure Astute Capital “remained fully compliant throughout the entire investor marketing and on-boarding process”.

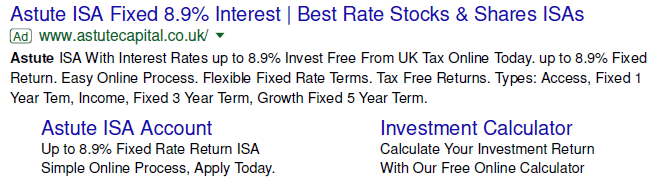

Whether Thistle had anything to say about Astute Capital’s risk-warning-deprived Google ads direct to investors is not known.

Nor is it known whether Thistle had any say in Astute’s marketing strategy of scrubbing the Internet of posts critical of the company, which we know from the evidence it left took place between June 2019 and November 2019 (when I noticed it).

Astute has provided the FCA and other unspecified third parties with “due diligence packs” prepared by Thistle, and apparently intends to consider becoming FCA regulated in 2020. Good luck to them with that.

Astute has been hit by the collapse of Reyker Securities, which acted as custodian for a large number of Astute investors. No investor funds are missing as a result of Reyker’s failure according to Astute’s director.

Investor funds are on-lent to Astute Capital Advisors. At time of writing ACA is nearly a month overdue with its accounts.

They are already regulated it seems, their website states:

This website has been issued by ASTUTE CAPITAL PLC and approved for the purposes of section 21 of the FSMA Infinity Wealth by Design Limited (‘Infinity’) is authorised and regulated by the Financial Conduct Authority under reference 750880.

A google search of Infinity shows a website https://www.infinityinvest.co.uk/ a company that shares the same address of Astute.

No – section 21 is an exemption (perhaps “loophole” is a better word). Unregulated investments are not allowed to market direct to the public and that includes web sites. However they can ask a regulated firm to sign it off at which point they are then allowed to show the web site. In no way does it mean Astute Capital are themselves regulated.

In my opinion Section 21 should be abolished as it is too open to abuse.

No – section 21 is an exemption (perhaps “loophole” is a better word). Unregulated investments are not allowed to market direct to the public and that includes web sites. However they can ask a regulated firm to sign it off at which point they are then allowed to show the web site. In no way does it mean Astute Capital are themselves regulated.

So the company that has signed off Astute to be allowed to be marketed to the public also sells the product is this not a conflict of interest? Is it not strange they share the same office?

A bit strange. Also strange but probably irrelevant is that Infinity are 100% owned by Elicap Partners whose accounts are overdue and under consideration to be struck off https://beta.companieshouse.gov.uk/company/OC411347

As of 9th January, the compulsory strike off action was suspended …

When you see that pair of listings (gazetted for compulsory strike off, action suspended) in quick succession on a company’s filing history it means that HMRC has objected because the company’s tax filings aren’t up-to-date and agreed. HMRC get a full list of gazettes from Companies House (they’re always batch-run on a Tuesday night) and their own computer seems to just match against tax filings and send a blacklist back to Cardiff.

They are saying they are only going after high net worths and sophisticated investors but are getting FCA regulated – why? What are they getting FCA regulated for to advise on their own bonds! Surely this would not be allowed! But who knows with the FCA!

Astute Capitals accounts are interesting they’ve raised £19.8m lent out £15.6m got £2.6m in cash that means £1.6m is missing! not to mention the interest that’s due on the raised amount! They also claim £43.3m in security, do we know if this is first or second has anyone got a register or their charges… Why has the auditor not put this detail in the Audit also I cannot see what the current interest liability is to date.

It clearly states that Astute Capital Advisors ltd covers all costs and liabilities which is 100% owned by the director of Astute Capital, Richard Symonds. A quick google search on Adrian Bloomfield the other director of the plc brings him up as a director for hire so I can’t imagine he has much involvement his personal websites lists all the companies he’s involved with but doesn’t mention Astute!

I’m confused, I cannot see any references to a bond only loans?

What do you mean?

I meant, I can’t see info on the bond anymore.

The issue seems to be astute capital advisors as their accounts are now overdue!

Is this just another ticking time bomb? I really hope not!

Astute Capital Advisors accoutns are now online! At least they are transparent they show a loss of just over £3.3m and introducer commissions being paid to the owner of Astute to a company that looks like it never traded, Symonds Capital Limited. What I do not get is it has investment in a car funding company, Simple Car Funding Ltd I thought Astute is a property Bond? Is this just a company for the owners to buy cars for themselves?

Having had a look at their website they now have no Section 21 on their site… This is looking very similar to what Blackmore did when the FCA stopped them from marketing, is history repeating itself on this one. They also have a fraud warning on their site as their Administrator Reyker has gone into Administration!