Astute Capital is offering bonds paying up to 8.9% simple interest as follows:

- Access – 3.2% over a 1 year term

- Income – 7.5% per year income paid out bi-annually

- Balance – 7.64% per year interest (on a compounded basis) rolled up and paid out after 3 years

- Growth – 7.64% per year interest (on a compounded basis) rolled up and paid out after 5 years

The website incorrectly states that the Balance and Growth bonds offer 8.24% and 8.9% interest respectively. This is on an annual simple interest basis, which is irrelevant as the interest is only paid out at the end of the 3/5 year term. The correct basis is compound interest.

It is not clear why investors would want to invest in the five year bonds when they pay the same compounded interest rate as the three year bonds, but the three year bonds pay out earlier.

The bonds are listed on the Irish stock exchange, but investors need to be aware that they will only be able to sell them on the exchange if there are willing buyers at that time.

Who are Astute Invest?

No details of who is behind the business are provided by Astute’s website. A “Meet The Team” page is accessible via Google, but it is orphaned (there are no links to it on Astute’s main website), out of date and contains only placeholder images of the directors, suggesting it is not intended to be live.

Astute Capital plc was incorporated in October 2016 by Alistair Moncrieff and Timothy Smith. Smith resigned as a director in November 2018. Moncrieff resigned a week ago on 26 February 2019. Alistair Moncrieff was described in the most recent Companies House accounts as Chairman and co-founder.

Prior to co-founding Astute Capital, Alistair Moncrieff was director and owner of Life and General Limited (formerly BCP Admin Limited) which ran an insurance comparison website, beprotectedinsurance.com. Beprotected went into liquidation in November 2017, owing just over £1 million to creditors. A recent update from the liquidator states that any recovery is highly unlikely.

Astute Capital plc has declared to Companies House that there is no identifiable person with significant control over the company, which is highly unusual.

A statement submitted to Companies House in November 2018 states that the company’s share capital is owned by D&A Nominees, which is a nominee company owned by Druces LLP, a firm of lawyers.

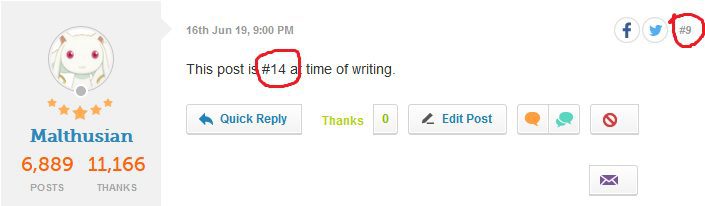

The remaining directors of Astute Capital registered with Companies House at time of writing are Richard Anthony Symonds and Adrian Francis Bloomfield.

Astute says grandly on its “About Us” page that “Astute Capital Plc raises money through its £500 million publicly listed bond program that has been approved by the Central Bank of Ireland.” The £500 million figure is rather irrelevant as Astute has not raised anything close to that amount. Its accounts for March 2018 disclosed that it had raised a total of £8 million via its bonds as at September 2018. (This comprises £1.1 million up to the balance sheet date of March 2018 and £6.9 million post-balance sheet as at the date the accounts were filed.)

How safe is the investment?

Astute Capital is promoted by Google ads which describe its investments as “Fixed Return, Easy Online Process.” No capital-at-risk warnings are provided in the advert.

Astute Capital is also promoted via Facebook ads from a Facebook page entitled “Savings Explained”, which ironically fails to explain that Astute Capital’s products are investments and not savings products.

It is important that investors understand that these are loans to a small company and if Astute Capital is unable to make sufficient returns by lending out its investors’ money, or for any other reason runs out of money to service its bonds, investors risk losing up to 100% of their money.

In its accounts made up to 31 March 2018, Astute Capital states that money loaned to it by borrowers will be loaned onward to TAR Asset Management Limited at 9% per year. TAR is “an alternative finance provider to challenger banks in the secured lending space”. TAR has subsequently been renamed to Astute Capital Advisors Limited. It is wholly owned by Richard Symonds, the sole director.

These March 2018 accounts state that at the time of the accounts, it had not had the opportunity to start advancing loans to TAR.

However, the accounts do state that the company was owed £1,082,000 by Brunswick Court Limited (formerly Astute Investment Management Limited), “a special purpose vehicle to carry on select property development projects”.

This is contradicted by the March 2018 accounts of Brunswick Court Limited itself, made up to the exact same date as Astute Capital plc’s, which show nothing on the balance sheet but an £84 debt. Brunwsick Court Limited is wholly owned by Timothy Smith (Astute Capital’s co-founder), who is also sole director.

Asset backed investment

Astute states that when it lends investors’ money to a company, it takes security over that company’s assets which is worth more than the money it lends.

Investors should bear in mind that it is not enough for Astute to get its money back by selling the security in the event its borrowers default. It needs its borrowers to pay Astute sufficient interest to allow it to consistently pay up to 8.9% a year (simple interest basis) to its investors, while meeting its costs.

Secured lending is not risk-free as there is also the risk that if the underlying borrower defaults, the security cannot be sold for enough to cover the loan.

Investors in asset-backed loans have been known to lose 100% of their money when it turned out that there were not enough assets left to pay investors after paying the insolvency administrator (who always stands first in the queue).

We are not in any sense implying that the same will happen to investors in Astute Capital, only illustrating the risk that is inherent in any loan note even when it is asset-backed.

If investors plan to rely on this security, it is essential that they hire professional due diligence specialists to confirm that in the event of a default, the assets of Astute Capital and its borrowers would be valuable and liquid enough to compensate all investors.

Should I invest in Astute Capital?

This blog does not give financial advice. The following are statements of publicly available facts or widely accepted investment principles, not a personalised recommendation. Investors should consult a regulated independent financial adviser if they are in any doubt.

As with any individual loan note in a new startup, this investment is only suitable for sophisticated and/or high net worth investors who have a substantial existing portfolio and are prepared to risk 100% loss of their money.

Any investment offering yields of up to 8.9% a year (on a simple interest basis) should be considered very high risk. As an individual, illiquid security with a risk of total and permanent loss, Astute Capital’s loan notes are much higher risk than a mainstream diversified stockmarket fund.

Before investing investors should ask themselves:

- How would I feel if the investment defaulted and I lost 100% of my money?

- Do I have a sufficiently large portfolio that the loss of 100% of my investment would not damage me financially?

- Have I conducted due diligence to ensure the asset-backed security can be relied on?

The investment may be suitable for high net worth and sophisticated investors who will already be well aware of all of the above risks, are looking to invest a small part of their assets in corporate lending, have done sufficient due diligence, and feel that the return on offer is sufficient for the risks involved in lending to a new startup company.

Their due diligence advisers will need to start by sorting out the discrepancy between the accounts of Astute Capital plc and its sister companies, Astute Capital Adviser Limited (formerly TAR Asset Management) and Brunswick Capital Limited (formerly Astute Investment Management Limited).

If you are looking for a “secured” investment, you should not invest in corporate loans with a risk of 100% loss.