A couple of weeks ago West Ham sponsor Basset & Gold (reviewed here in December 2017) collapsed into administration.

So far so normal. Unregulated high risk investment fails, news at 11.

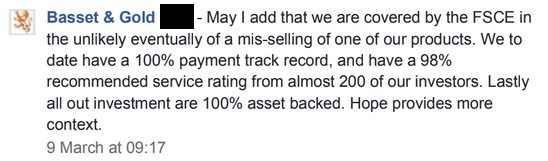

What was unusual about Basset & Gold is that back in 2018 at least, they were promoting their bonds while explicitly holding out that investors might be compensated by the FSCS if things went sour – on the basis of misselling.

Although Basset & Gold Plc has also entered administration, FSCS is unlikely to be able to pay compensation based purely on Basset & Gold Plc’s failure to repay the bonds, as issuing bonds is not normally a regulated activity.

For FSCS to be able to pay compensation, the customer must have been mis-sold their bonds, for example, because they relied on a misleading statement about how Basset & Gold Plc was investing their money.

How many Basset & Gold investors were missold the bonds? The Financial Conduct Authority suggests it’s quite a lot.

The FSCS has determined that many investors have a good prospect of claiming compensation. […]

We had concerns around the accuracy and fairness of B&G plc’s financial promotions of the mini bonds.

As a result, B&G Finance made improvements to its advertising in December 2018 and wrote to all bond holders in January 2019 clarifying that B&G has used ‘the vast majority of Bond proceeds to finance a large facility agreement with an FCA-regulated short-term consumer lender’.

No further bonds were issued to retail investors from May 2019.

In short, the FCA was concerned that B&G plc was misselling Basset & Gold bonds until May 2019. So anyone who invested in Basset & Gold prior to their clarifying their investment literature in response to an FCA investigation, which will be most of them given that Basset & Gold closed to new investment in May 2019 (10 months before it collapsed), potentially has a claim for misselling. This is not according to me or some claims management firm trying to drum up business, this is according to the FCA.

That said, we’ve been here before.

London Capital & Finance, which collapsed at the beginning of last year, was also FCA-regulated. The vast majority of LCF investors are waiting to find out whether they will receive compensation. Early indications from the FSCS are far less positive than the message given to Basset & Gold investors above.

While FSCS maintains that the act of issuing mini bonds is not a regulated activity, and is therefore not something we protect, we have concluded there will be some customers who were given misleading advice by LCF and so have valid claims for compensation. However, we expect that many customers will not be eligible for compensation on this basis.

So whether Basset & Gold investors will be compensated en masse is still not clear.

How did we even get here?

Back in 2015 two minibond companies, Secured Energy Bonds and Providence Bonds, collapsed with total losses to investors. Both were promoted by the same FCA-regulated company, Independent Portfolio Managers, which signed off their literature (allowing the bonds to be legally promoted to the public) and also acted as Security Trustee.

As a result of IPM’s involvement, investors in Secured Energy Bonds and Providence Bonds were – after a legal struggle – compensated by the FSCS.

In retrospect therefore, both bonds were risk-free. If the bonds had succeeded investors would get higher returns than cash, and as they failed investors were bailed out by the FSCS. (Which is to say the general public.) Naturally the investors didn’t know at the time they would be bailed out, and they faced years of stress and worry while their lawyers fought the Financial Ombudsman, but that is the position with the benefit of hindsight.

The IPM literature was misleading at the time it was being issued to investors, and the legal position is that this made them eligible for compensation from IPM, and in turn the FSCS, if the investment failed (even if it took the FOS a while to acknowledge it). So the investment was in reality risk-free from the beginning – unless investors exceeded the FSCS limits (£50k at the time).

Basset & Gold have essentially attempted the same setup as IPM + Secured Energy Bonds (or Providence). One company issues the bonds (SEB bonds / B&G PLC). Another FCA-regulated company promotes them (IPM / B&G Finance). The bond issuer goes bust. Investors complain that they were missold by IPM / B&G Finance. FSCS bails them out – or has strongly suggested it will bail them out in the case of B&G.

The difference is that if Basset & Gold investors are compensated, Basset & Gold will essentially have executed a risk-free Secured Energy Bonds type scheme in advance, having successfully arranged its business to ensure that investors would be compensated by the FSCS, and having promoted its bonds to investors on the basis that the FSCS would step in, as per the Facebook screenshot above.

Back in September 2018 I asked (deliberately provocatively) whether the precedent set by IPM had made all unregulated investments risk-free, providing they took the fairly trivial step of setting up an FCA-regulated company to approve the investment literature, which is about as difficult as cutting out two tokens from a cereal packet and sending it to the FCA. (Unlike giving financial advice, signing off investment literature does not require professional qualifications and specific permission from the FCA.)

The collapse of LCF appeared to show it hadn’t. When they bailed out SEB and Providence investors the FOS inserted an anti-precedent device into its reasoning, stating very specifically that SEB and Providence investors were being compensated because IPM was particularly closely intertwined with the businesses it was promoting. IPM did not just sign off the literature but act as Security Trustee. This didn’t apply to London Capital and Finance, which both issued and promoted its own bonds.

However the much more positive noises made by the FSCS and the FCA towards Basset & Gold investors – “The FSCS has determined that many investors have a good prospect of claiming compensation” – seems to have turned that on its head again.

What is there to stop somebody else following the same business model as Basset & Gold – forming one company which issues the bonds, and another which obtains FCA registration and promotes the bonds – and offering whatever rate it feels like to attract investors, on the basis that investors will be bailed out by the general public on the basis of misselling?

Only the FCA taking prompt action to stop the misselling.

Basset and Gold started in its current business model in late 2015 (when an off-the-shelf company called Bladegold was acquired and renamed). Readers have alleged that its activities were reported to the FCA in 2017. No visible action was taken by the FCA until December 2018 when B&G changed its literature, and B&G was eventually stopped from taking new money in May 2019, before collapsing 10 months later.

So in other words, we – that is, all of us who pay FSCS levies via our bank accounts and pensions – are screwed.

Until the UK reforms securities laws to ensure that all investment securities offered to the public are registered with the regulator, as is the case in the USA. This would remove the current discrepancy where the promotion of investments is regulated (and FSCS-covered) but investments are not.

More public subsidy for West Ham

Another angle on the Basset & Gold story is the remarkable ability of West Ham to source money from the general public.

There is in reality no difference between the taxpayer and the FSCS-levy-payer as everyone in the UK pays taxes and everyone in the UK uses financial services.

West Ham already play in a stadium that was built by the taxpayer for the 2012 Olympics. As you don’t get crowds of 50,000+ to watch humans running in circles unless the Olympics is on, and the Olympics comes to the UK once in a lifetime, West Ham were allowed to rent the stadium on very favourable terms, to avoid the embarrassment of the Olympic Stadium being knocked down for flats.

Basset & Gold investor money was used to fund sponsorship to West Ham. If the FSCS bails out Basset & Gold investors to any substantial degree, that means the general public’s money replaces Basset & Gold investors’ money in that equation.

It’s almost as if a former Prime Minister was a West Ham FC fan.

[This is an article about Basset and Gold. Off-topic silly conspiracy theory removed. -Brev]

You know the scammers have been hurt by this web site when you see rubbish like this posted. I have no idea of Brev’s identity and don’t care but the page referenced is hilariously bad. Apparently Brev is using this website to drum up business for her business… even though she (if Brev is a she) remains anonymous. How does that work exactly?

Back on topic let’s hope the ludicrous possibility of all unregulated investments becoming FSCS backed finally makes the government and FCA wake up and do something about it, rather than continuing to turn a blind eye.

What these geniuses seem to have missed is that in WordPress you can delete nonsense spam with a single click. Even with a copy-and-pasted post, going to random web pages and filling in the comment form still takes some effort, compared to the single second it takes to push the Spam button.

So I’m happy for them to try to spam the blog with nonsense (although I’m not going to let it sit there and clog up comment threads) because it is probably better they waste their time doing that than whatever else they’d be doing instead.

(NB: No offense to real posters but this subject is closed to avoid feeding the trolls.)